In an age, when global and domestic funds seem to dominate the markets, the perception is that it has become more and more difficult for the independent trader to have much of an edge. But, the truth is that a few trading tricks and a little common sense will get you more mileage than all the books on technical analysis combined.

In this ten part series, I will pick up some of the commonly used trading indicators and walk you through the steps on how you could combine them suitably to create a profitable trading system for yourself. My aim is to give you a starting point so you can take these ideas or concepts and mold them into a plan that would work for you.

Building A Trading Plan

There are 3 key elements, when it comes to developing a sound trading system: Entry and exit signals, a plan for a trading stop loss and a sound money management strategy.

The first step involves generating the buy and sell signals, which can vary from trader to trader from being purely visual, or a result of some technical indicator, or an effective combination of two or more indicators.

Combining indicators in a wrong way can lead to a lot of confusion and wrong trading decisions. Hence, before we start working on combinations, it is important to get a basic understanding of the classification of each indicator.

Types of Indicators

Indicators help reveal underlying strengths and weaknesses of price action, which would not have been obvious otherwise from Price or Volume alone.

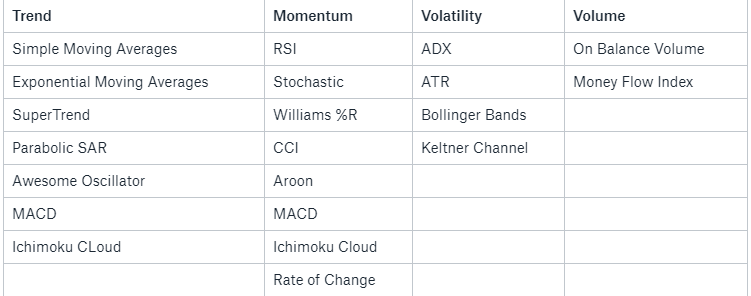

Broadly, all the technical indicators can be classified into 4 major types:

- Trend

- Momentum

- Volume

- Volatility

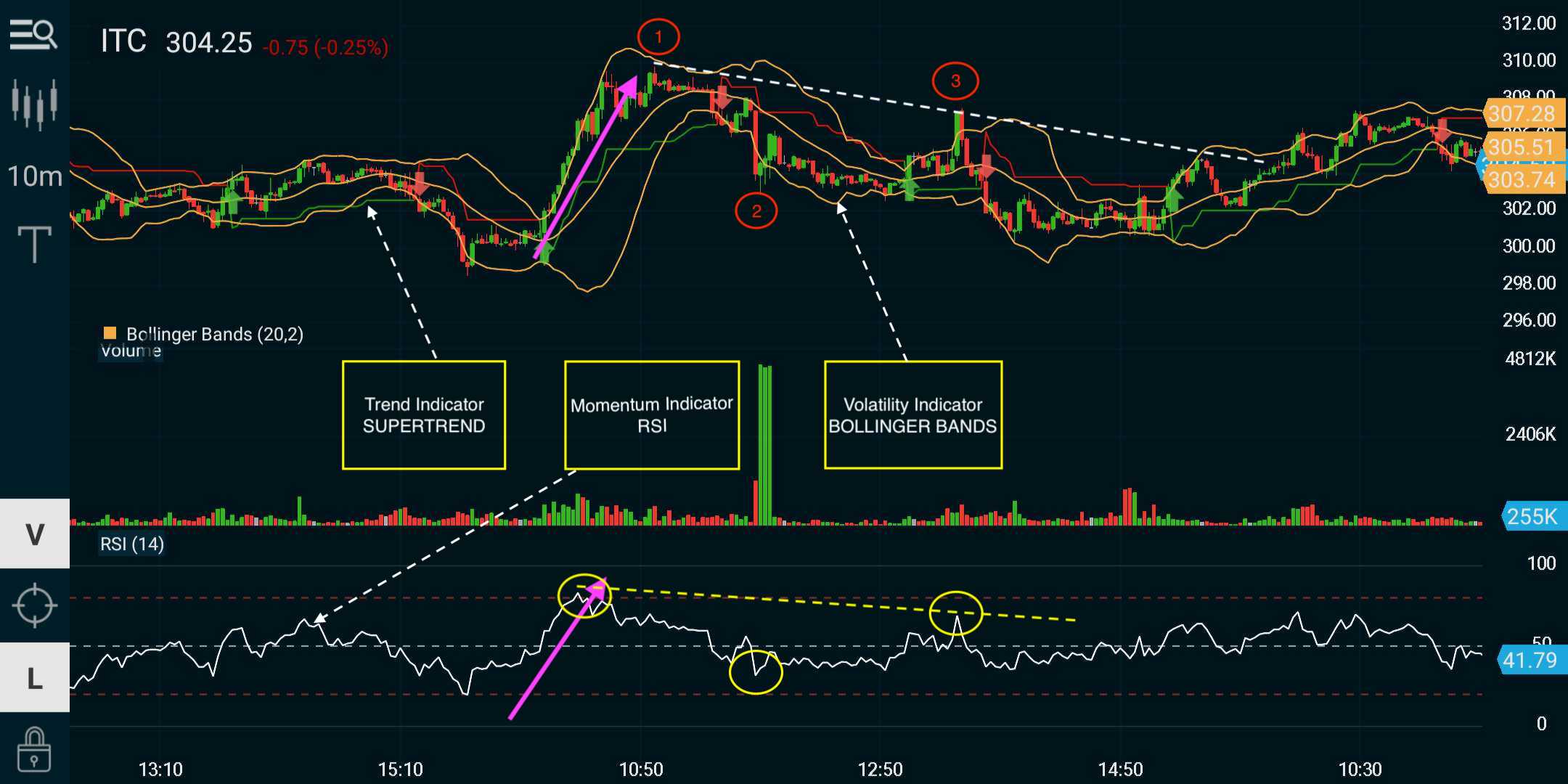

Trend indicators tell you which direction the market is moving in, or if there is a trend at all. The common trend indicators like Moving Averages, Supertrend & Parabolic SAR are overlayed on price or others called oscillators (MACD), because they tend to move between high and low values like a wave.

Momentum indicators tell you how strong the trend is and can also tell you if a reversal is going to occur. They can be useful for picking out price tops and bottoms. Momentum indicators include Relative Strength Index (RSI), Stochastic, Average Directional Index (ADX).

Volume indicators tell you how volume is changing over time, how many units are being bought and sold over time. This is useful because when the price changes, the volume gives an indication of how strong the move is. Bullish moves on high volume are more likely to be maintained than those on low volume. Volume indicators includes On-Balance Volume, Volume Rate of Change etc.

Volatility indicators tell you how much the price is changing in a given period. Volatility is a very important part of the market especially for traders, and without it there’s no way to make money! The higher the volatility is, the faster a price is changing. It tells you nothing about direction, just the range of prices. Low volatility indicates small price moves, high volatility indicates big price moves. Eg: Bollinger Bands, ATR

Table: Classification of Indicators

Pick your Indicators carefully

Trading from a single indicator will not make you rich. Each indicator has it’s own limitations and will not be correct 100% of the time. But you can use these indicators in combination to get better signals and overall make more profitable trades.

However, care should be taken to not combine indicators that belong to the same indicator class to generate trading signals i.e two trend indicators like Parabolic SAR & Supertrend or two momentum indicators like RSI & Stochastic together. This will end up providing the same information making them redundant like in this example below. You can see all the indicators form highs and lows simultaneously as marked by the vertical lines.

In the forthcoming weeks, we will discuss trading strategies with specific pairs of indicators and how to set the parameters so that you can combine them effectively to create profitable trading systems.

Read our next article in the series, that will help you combine PSAR and Stochastic.