In the last couple of weeks, we have focused on using the scanner for intraday breakouts. Even if you’re not necessarily trading everyday, you must continue scanning and studying these breakouts, and how the charts unfold. The more you study them, the better you’ll understand how to trade them.

This week let’s take a look at two strategies popularly known as the NR4 and NR7 which are useful for spotting breakouts from narrow ranges.

Narrow Ranges

If you look at the price chart of any traded scrip, be it a stock, a commodity or a currency, one observes that the prices are not making large moves all the time. They go through stormy periods where the volatility increases causing large moves and periods of calm, where the prices stay subdued in narrow ranges. Traders refer to these as expansions and contractions of volatility.

So, when the volatility contracts and the range narrows, and there is a breakout brewing, it is often referred to as the calm before the storm. As a trader, you want to participate in the next big move as and when it unfolds.

The Narrow Range Breakout scans are excellent strategies to find stocks when such moves occur. First, I think it’s important to understand the concepts behind Narrow Range breakouts before diving into trading them. Let’s do that.

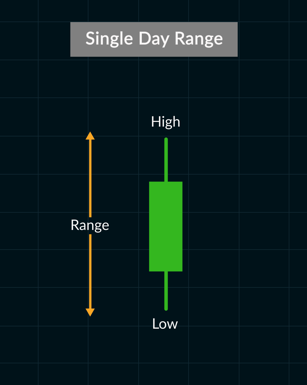

Day's Range

A single day’s range is defined as the difference between the high price and the low price for the day.

Narrow Range 4 (NR4) Candle

The NR4 candle is the narrowest range bar (candlestick) in the last 4 trading days. The NR4 pattern is made of of 4 bars. The 4th bar will have a range that is much smaller than the previous three candlesticks. Also remember, when we talk about NR bars we are referring to daily candles only.

Narrow Range 7 (NR7) Candle

Similar to the NR4, the NR7 candle is the narrowest range bar (candlestick) in the last 7 trading days. The NR7 pattern is made of of 7 bars. The 7th bar will have a range that is much smaller than the previous three candlesticks.

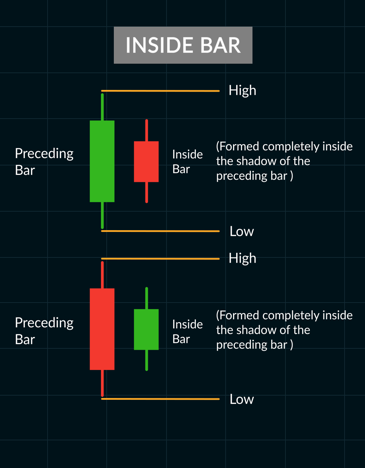

The Inside Bar (IB) Filter

It’s a two candlestick pattern. The second candlestick that forms is engulfed completely within the shadows of the first larger candlestick. The second candlestick is called the inside bar.

NR4/NR7 and Inside Bar

Candlesticks which qualify as a Narrow Range Bar (NR4 or NR7) and an Inside Bar hold a lot of significance for traders.

It shows a period of consolidation and we can take advantage of the next breakout with a better probability of profit.

Trading Rules:

Timeframe: Daily charts

NR4 and IB Buy Rules

- Identify the NR4 and IB candle.

- Place buy order above the high of the NR4 bar

Stop loss: Place your stop loss below the low of the NR4 bar.

Taking Profits:

- For Day Traders: Exit if you get a profit that is 3 times your stop loss or at the end of day (EOD) if stop loss hasn’t been taken out.

- For Swing Traders: Exit either when previous day’s low is broken or when a previous swing high is reached.

NR4 and IB Sell Rules

- Identify the NR4 and IB candle.

- Place sell order above the high of the NR4 bar

Stop loss: Place your stop loss above the high of the NR4 bar.

Taking Profits:

- For Day Traders: Exit if you get a profit that is 3 times your stop loss or at the end of day (EOD) if stop loss hasn’t been taken out.

- For Swing Traders: Exit either when previous day’s low is broken as shown in the image or when a previous swing low is reached.

NR7 and IB Trading

The NR7 and IB trading follows exactly the same rules as the NR4 trades discussed above. The only difference is that we use an NR7 bar instead of an NR4 bar.

Scanning for NR4 and NR7

You can use the Market Pulse app to help you shortlist stocks to trade these strategies. The scans for this can be accessed from : All Scans > Breakout Scans.

They are:

- Narrow Range 4 Candle

- Narrow Range 4 Candle Breakout

- Narrow Range 7 Candle & Breakout

You can go through the video below to understand how the Scanner can be used to find NR trades.

See you next week with new topic 52 Week Breakout Strategies