Use a scanner to help automate your strategy and allow you to find trading opportunities more efficiently.

I often meet traders who are stuck in losing positions for long periods of time. Their explanation for holding on to a trade is, it’s a “good” stock which is bottoming out and reversing from here. When I tell them, they would be better off switching to other opportunities available, again the response is they “don’t know” of how to go about finding other stocks. Are you one of them?

Well, you are not alone. This is a chronic and common frustration with traders. But what if I tell you that there are proven, profitable stock picking strategies to solve this! Then again, don’t get me wrong. Just because you can pick winners, isn’t going to rule you out from ever having another loser. In fact, even the best strategies ‘only’ have win ratios of 70%. But if your strategy picks winners more often than losers, if you find yourself in a losing trade, you can quickly cut your loss and feel confident that your next pick will have a high probability of succeeding. And that’s why I think a good Scanner is essential in every trader’s toolkit.

In this ten part series, we’ll walk you through some Scan strategies to help you become a better trader. To start with, let’s look at some basic nuts and bolts about scanners.

Why Do You Need A Scanner?

There are over 2000 securities listed on the NSE. Picking the right stocks to day-trade can become an overwhelming experience for any trader. Do you go with the big names like Reliance and HDFC Bank? Or Do you pick the hot sector or stock in the news today? These questions must be analyzed and resolved.

What is a Stock Scanner?

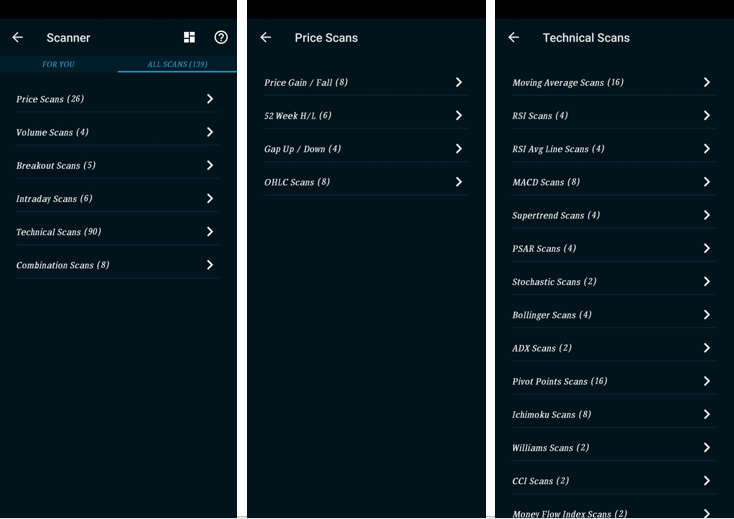

Technical scans can range from simple price alerts(new highs and lows), % price changes to technical conditions, to specific chart patterns all based on price and volume. Fundamental scans consist of financial metrics pertaining to the business operations like price earnings(P/E) ratios, revenue and income growth, book value and so on.

There are a wide range of simple to advanced scanners available today, but as a user we must keep in mind, they only help you shortlist. You still have to analyze and monitor. Trigger happy and less experienced traders must check themselves from falling into a overtrading trap.

Our Goal

We want to start using scans as part of our “Trading Process” to avoid getting overwhelmed by the array of fundamental and technical data in the market. We also want to regularly find stocks that are in high probability trade set-ups. One needs to select their criteria carefully, to filter through the market noise and detect stocks that are viable for trading. How does one do that?

To ensure this, you must have some basic criteria as well as specific criteria. Many scanners like on Market Pulse have several pre-programmed scans but they still may need to be tweaked for your personal preference to be most effective.

Qualities of a Good Stock Scan

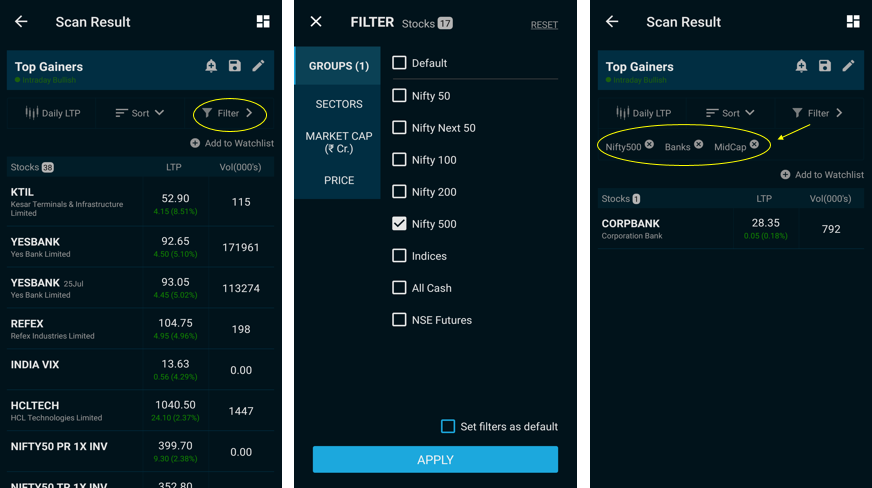

When specifying your stock scans, it’s important to filter out stocks that you normally wouldn’t trade in the first place. You can do this by specifying exchanges, average trading volume, price range and triggers, volume triggers, types of stocks and so forth.

Ideally, you want to have your scanner spitting out a handful of results. If the results number in the hundreds, then you know the parameters are too broad and need to be tightened up.

Pitfalls of Using Stock Scanners

A scanner can make good traders more effective, but it make a poor trader even poorer. One of the problems with scanners is that they find stocks their tops and bottoms. Smart money is fully aware that stocks making new highs or lows will hit the scanners and bring new people chasing the trades.

How to Effectively Use Stock Scanners

I recommend you to monitor and observe new stocks from your scan results for sometime rather then plunge into a trade head on. Some stocks have clean breakouts while others breakout after a fake price dip. This can only be confirmed from observing the stock first and foremost. This takes time and patience. Also keep in mind that scanners will find patterns after they have formed. Use the stock scan results to find initial candidates that you observe first and then adopt after observation. Trade them only after monitoring both upside and downside moves and how they correlate with their peers and the general market. Apply your indicators first and wait for the trade to come to you. Preparation is the key here.

A Scanner is a Tool and Nothing More

As you begin using stock scanners, it’s important to remember that a scanner is just a tool, and like any tool, it’s effectiveness relies heavily on its user. It’s up to you to analyze each stock that shows up on your scanner in order to make sure it is a great trading opportunity.

Strategies Coming Up

In the coming articles in this series, we’ll take a closer look at some of the scanning strategies one can employ to improve our trading. Meanwhile, you can also go through these articles to understand using the Scanner on Market Pulse.

Getting Started with Pro Stock Scanner

How to: Use filters to fine tune your universe

Daily LTP vs Daily EOD vs Intraday Scans

Auto Scan - What is it & How to use it?